Semiconductor Research

GLOBAL SEMICONDUCTOR OVERVIEW

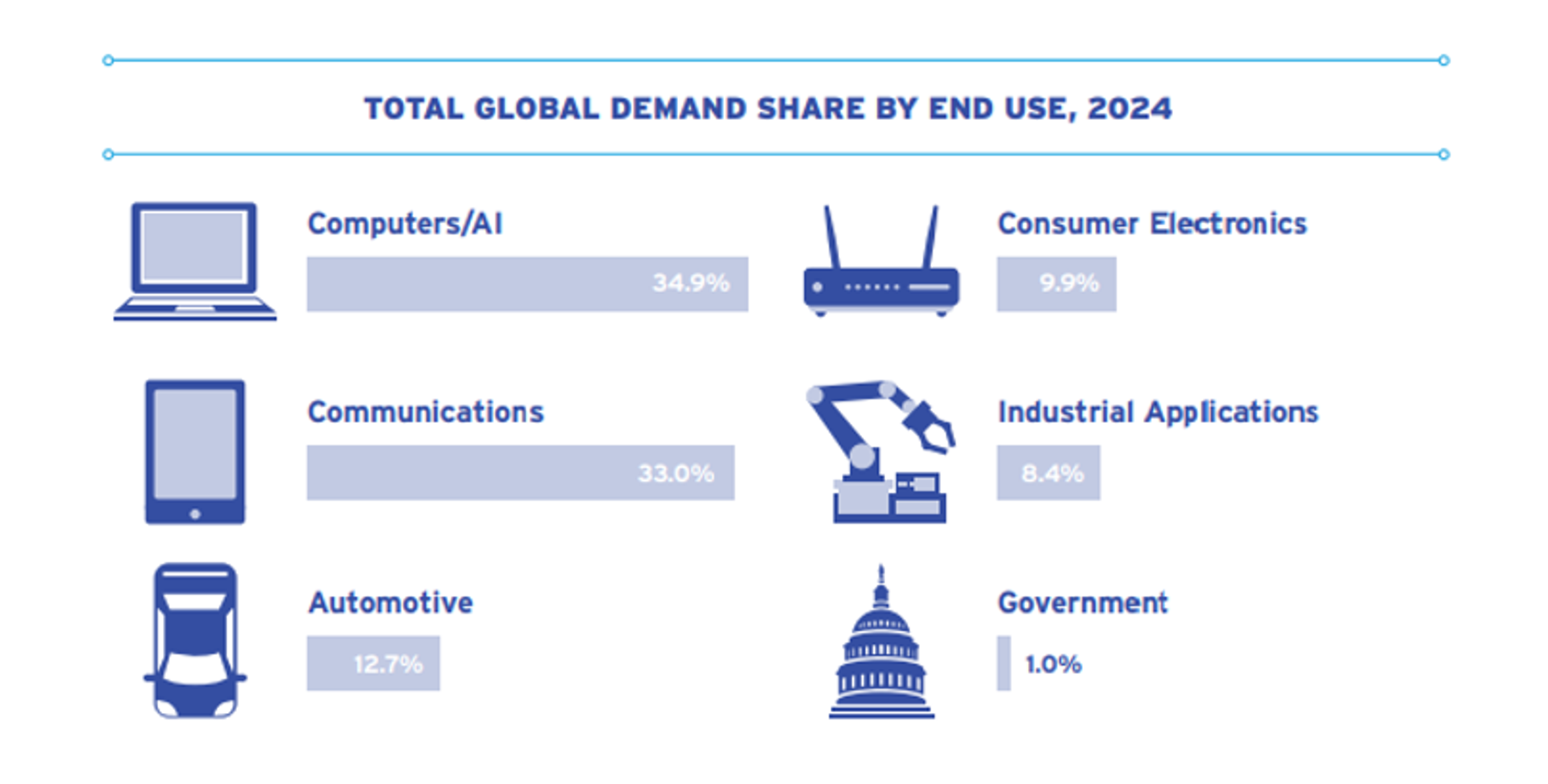

The semiconductor industry is the foundational pillar of the digital economy and global technological innovation. From AI, electric vehicles, IoT devices, to defense and aerospace, every sector relies on chips. The disruptions following the pandemic and the global chip shortage have driven a comprehensive restructuring of the semiconductor supply chain, marking the beginning of a new growth phase.

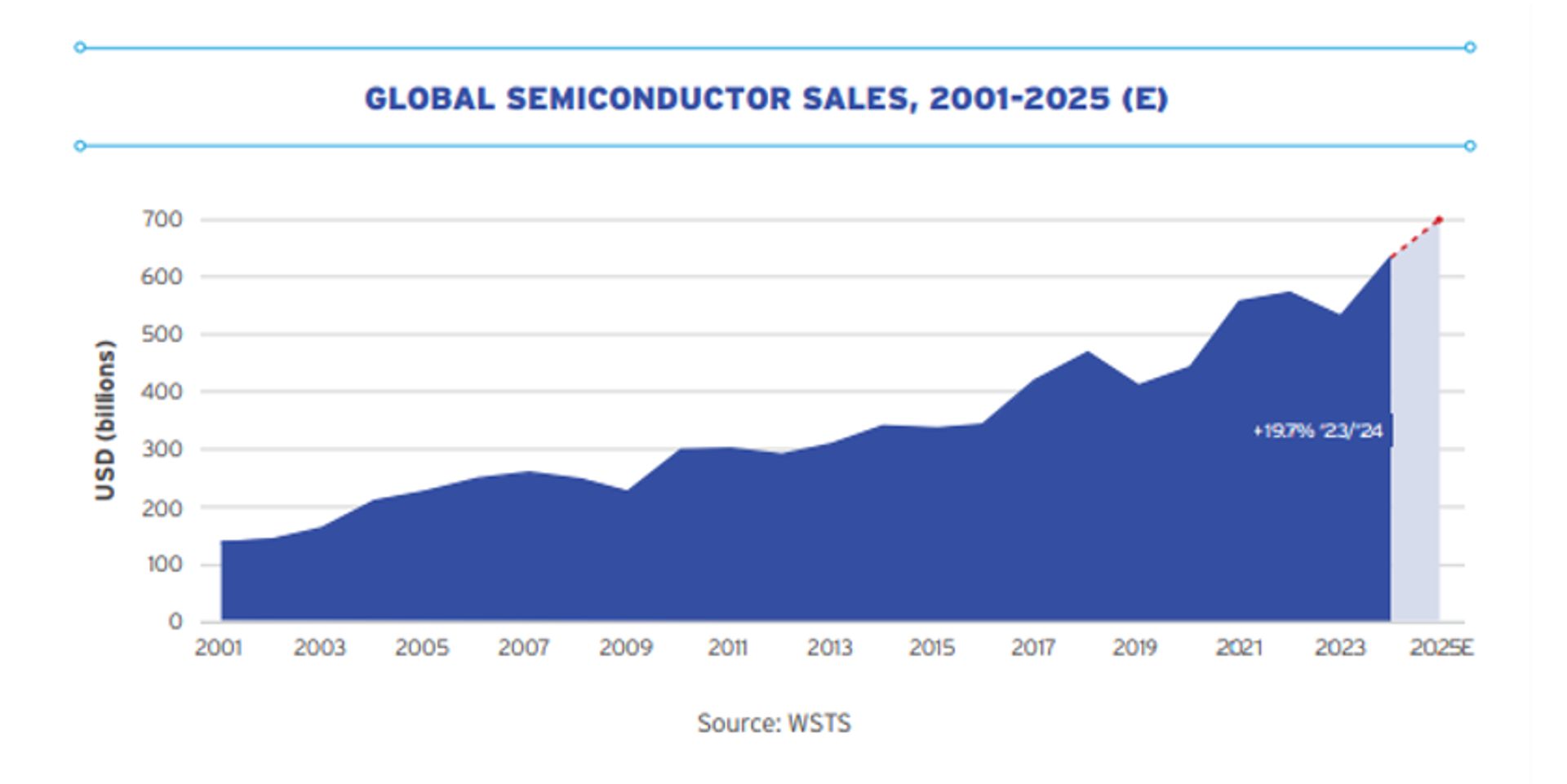

Market Size & Growth Rate

According to the Semiconductor Industry Association (SIA), global semiconductor revenue reached USD 630.5 billion in 2024 and is projected to rise to approximately USD 700 billion in 2025, representing an increase of 11.2%. PwC forecasts that the market could reach USD 1 trillion by 2030, with an average annual growth rate of 8–9%.

Global Growth Drivers

Artificial Intelligence (AI):

Electric Vehicles & Software-Defined Vehicles (EV/SDV):

Internet of Things (IoT) & Digitalization:

Difficulties & Challenges

The global semiconductor industry is undergoing significant restructuring as the U.S., EU, Japan, and South Korea push for greater technological self-sufficiency, supported by major policy initiatives such as the CHIPS Act and the European Chips Act. This shift is driving production away from China and toward emerging hubs in Southeast Asia and India. However, the industry continues to face serious challenges, including a widespread shortage of skilled engineers—Europe alone is projected to lack 350,000 by 2030—along with limited supplies of critical materials such as rare metals and ultrapure water. Geopolitical tensions between the U.S. and China, as well as across the Taiwan Strait, further heighten risks, while rising R&D and manufacturing costs add additional pressure to the global semiconductor ecosystem.

Overall, with the rapid pace of innovation, the semiconductor industry is expected to continue its strong growth and maintain its pivotal role in the global digital transformation. To sustain this momentum, countries need to enhance investment in research and development (R&D), nurture STEM talent, strengthen international cooperation, and establish stable, balanced, and sustainable trade and technology security policies.

VIETNAM SEMICONDUCTOR OVERVIEW

Vietnam’s semiconductor industry is entering an important stage of development, emerging as a key destination for foreign investment and global supply chain restructuring. Although still in the early stages, Vietnam possesses significant potential to become an essential link in the global semiconductor ecosystem, especially as U.S., South Korean, and Asian corporations diversify beyond China.

According to Guotai Junan Securities (Vietnam), Vietnam’s semiconductor revenue reached USD 17 billion in 2023 and is expected to grow at a CAGR of 11% between 2024–2027, reaching USD 31 billion by 2027—one of the highest growth rates in the region.

Vietnam’s Key Advantages

FDI Wave into Vietnam’s Semiconductor Industry

Major global corporations such as Samsung, Amkor, Intel, Nvidia, Synopsys, and Marvell are expanding factories, design centers, and R&D operations in Vietnam. Notable projects include Amkor’s USD 1.6 billion plant in Bac Ninh, Samsung’s USD 850 million semiconductor component project, and Synopsys and Marvell’s design centers in Ho Chi Minh City. These developments highlight Vietnam’s rising strategic position in Asia’s semiconductor supply chain.

Challenges Facing Vietnam

Recognizing both opportunities and challenges, the Vietnamese government is developing a comprehensive semiconductor strategy: establishing national innovation centers, high-tech investment funds, strengthening partnerships with the U.S. and South Korea, and setting a target to train 50,000 semiconductor engineers by 2030.

Vietnam’s Future Prospects

Vietnam’s semiconductor industry remains in its early stages but is growing rapidly. With strong government support, rising FDI, and competitive human resources, Vietnam has the potential to become one of Asia’s important semiconductor centers in the coming decade.